As a proud member of the UK200Group, Anderson Barrowcliff is delighted to share insights from the 2024 SME Valuation Index, which reveals encouraging trends for business owners considering selling. The Index, compiled by MarktoMarket using data contributed by UK200Group members, highlights robust growth in SME valuations and signals confidence in the UK mergers and acquisitions (M&A) landscape.

Key Highlights:

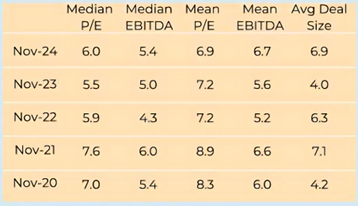

- Rising EBITDA Multiples: Median EBITDA multiples increased to 5.4x in 2024, up from 5.0x in 2023, underscoring improved investor confidence.

- Stable Deal Volumes: Transaction volumes held steady in early 2024, with a significant uptick in activity during the third quarter.

- Favourable Economic Conditions: Falling interest rates and greater political stability have contributed to a stronger foundation for M&A activity.

The UK economy's resilience, evidenced by GDP growth forecast of 2.0% in 2025 1, inflation set to average around 2.6% in 2025 2, and rising employment rates of 74.9%3 , has created a positive environment for business transitons.

Speaking on the findings, James Dale of Anderson Barrowcliff noted:

"The increase in SME valuations reflects not just market confidence, but also the resilience and adaptability of UK businesses. Whether you're looking to sell your business or acquire one to fuel growth, now is an opportune time to act. With favourable economic conditions and supportive policies, 2025 looks set to build on this momentum."

The SME Valuation Index offers invaluable insights for business owners, investors, and advisers exploring the opportunities of the UK M&A market. As trusted advisers in business sales, acquisitions, and succession planning, Anderson Barrowcliff is here to help clients capitalise on these trends.

For more information or to discuss how this data could impact your business plans, please contact James Dale at Jamesd@anderson-barrowcliff.co.uk.

1

https://commonslibrary.parliament.uk/research-briefings/sn02783/#:~:text=GDP%20growth%20forecasts,2024%20and%201.3%25%20for%202025.

2

https://www.reuters.com/world/uk/uk-inflation-average-26-2025-obr-forecasts-2024-10-30/

3

https://researchbriefings.files.parliament.uk/documents/CBP-9366/CBP-9366.pdf